- Industry Solutions

Industry Solutions

From reshaping the quote to cash process, to transforming engagement with channels partners, to achieving excellence in global product launch, Model N enables digital reinvention with industry-specific solutions that maximize revenue.

- Right block

- Industry Solutions

Industry Solutions

From reshaping the quote to cash process, to transforming engagement with channels partners, to achieving excellence in global product launch, Model N enables digital reinvention with industry-specific solutions that maximize revenue.

- Right block

- Products

Our Products

Model N delivers a platform for business reinvention, empowering companies to maximize revenue as they transform Sales, Marketing, Channels, Finance, and Legal processes.

- Right block

- Services & Support

Services & Support

To ensure you get the most out of your Model N investment Model N provides a complete set of professional Customer Success, Services and Support offerings designed to further your business and IT success.

- Right block

- Resources

- Resources

2025 State of Revenue Report

How do leaders plan to optimize revenue in 2025?

Eighty-seven percent of business leaders state that their company is focusing its innovation plans on automating revenue management operations. Learn how you can create smarter, more efficient revenue processes.

- Right block

- Resources

- Company

Company

Model N is the leader in revenue optimization and compliance for pharmaceutical, medtech and high-tech innovators. For more than 25 years, we have helped customers maximize revenue, streamline operations, and maintain compliance through cloud-based software, value-added services, and data-driven insights.

- Right block

Contact Sales

Ebook

Ebook

whitepaper

whitepaper

whitepaper

whitepaper

.

- Products

Our Products

Model N delivers a platform for business reinvention, empowering companies to maximize revenue as they transform Sales, Marketing, Channels, Finance, and Legal processes.

- Right block

- Services & Support

Services & Support

To ensure you get the most out of your Model N investment Model N provides a complete set of professional Customer Success, Services and Support offerings designed to further your business and IT success.

- Right block

- Resources

- Resources

2025 State of Revenue Report

How do leaders plan to optimize revenue in 2025?

Eighty-seven percent of business leaders state that their company is focusing its innovation plans on automating revenue management operations. Learn how you can create smarter, more efficient revenue processes.

- Right block

- Resources

- Company

Company

Model N is the leader in revenue optimization and compliance for pharmaceutical, medtech and high-tech innovators. For more than 25 years, we have helped customers maximize revenue, streamline operations, and maintain compliance through cloud-based software, value-added services, and data-driven insights.

- Right block

- Industry Solutions

Industry Solutions

From reshaping the quote to cash process, to transforming engagement with channels partners, to achieving excellence in global product launch, Model N enables digital reinvention with industry-specific solutions that maximize revenue.

- Right block

- Products

Our Products

Model N delivers a platform for business reinvention, empowering companies to maximize revenue as they transform Sales, Marketing, Channels, Finance, and Legal processes.

- Right block

- Services & Support

Services & Support

To ensure you get the most out of your Model N investment Model N provides a complete set of professional Customer Success, Services and Support offerings designed to further your business and IT success.

- Right block

- Resources

- Resources

2025 State of Revenue Report

How do leaders plan to optimize revenue in 2025?

Eighty-seven percent of business leaders state that their company is focusing its innovation plans on automating revenue management operations. Learn how you can create smarter, more efficient revenue processes.

- Right block

- Resources

- Company

Company

Model N is the leader in revenue optimization and compliance for pharmaceutical, medtech and high-tech innovators. For more than 25 years, we have helped customers maximize revenue, streamline operations, and maintain compliance through cloud-based software, value-added services, and data-driven insights.

- Right block

Quick Links

What you need to know, how you can prepare, and when you need to take action.

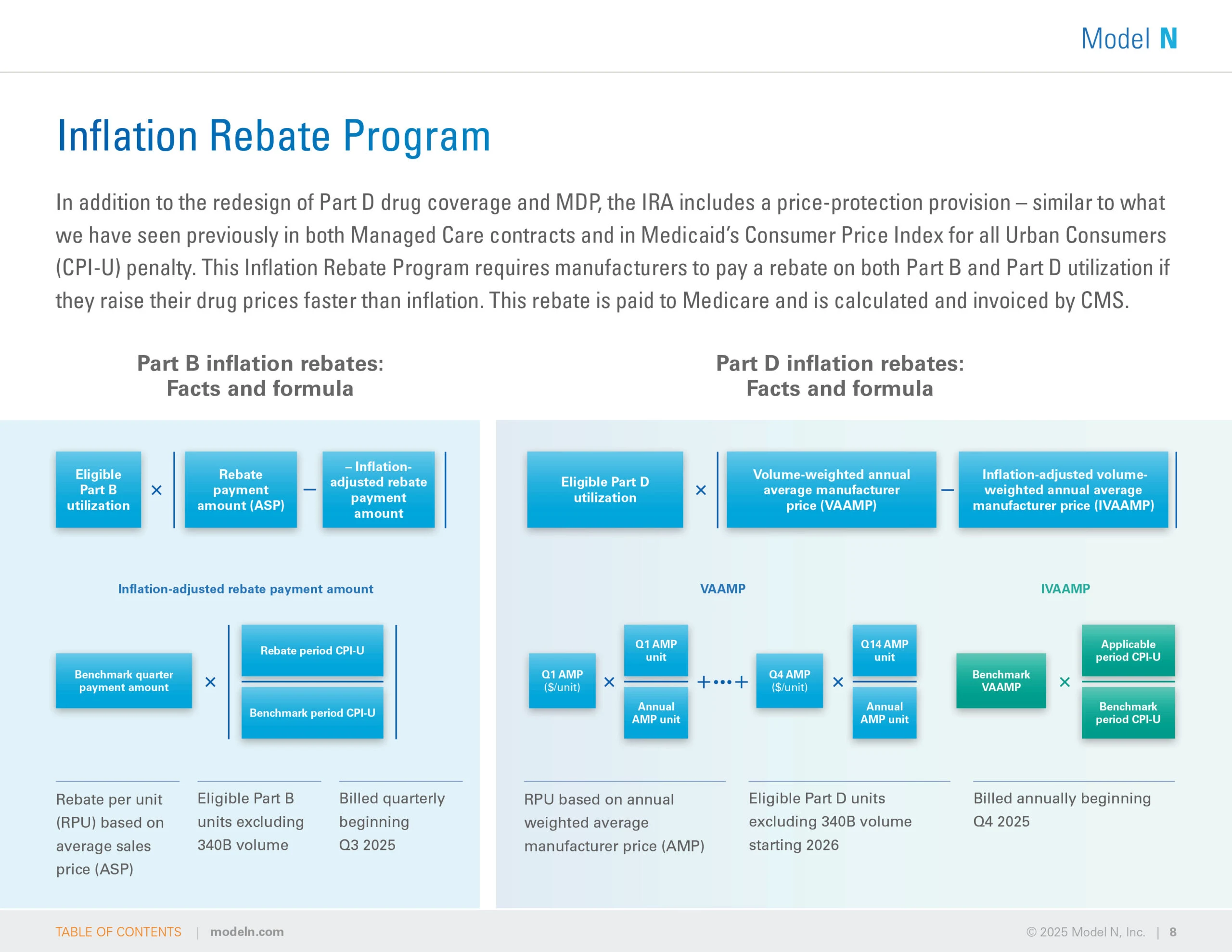

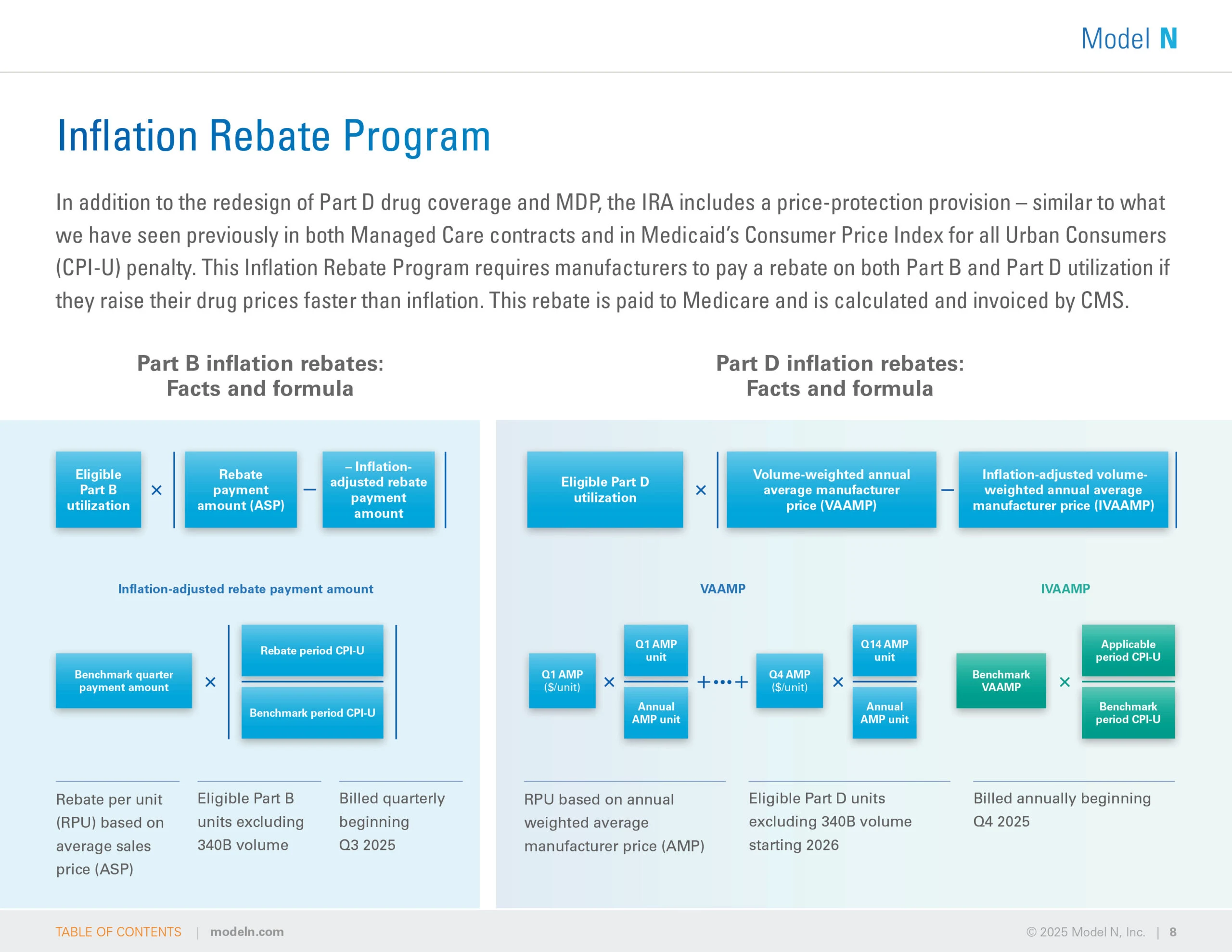

2025 is the year when much of the legislation set forth in the IRA will take effect, including three key provisions that will heavily impact many pharmaceutical manufacturers: the Manufacturer Discount Program (MDP), the Inflation Rebate Program, and the Medicare Drug Price Negotiation Program (MDPNP).

Challenges and opportunities

This eBook provides important information to help pharma manufacturers gauge the effect of the IRA on their business and develop effective strategies for managing and operating in the sea of regulatory change.

Key takeaways

- Understand the differences between the previously existing Coverage Gap Discount Program and its replacement, the MDP

- Access facts and formulas regarding Medicare Part B and Part rebates under the new Inflation Rebate Program

- See how manufacturers are pushing back on the MDPNP

- Get guidance on how to update your gross-to-net forecasts and accruals

- View a detailed timeline of how and when your team can prepare for effective management and operation under the IRA

Thank you for your interest in the ebook: Navigating the Inflation Reduction Act (IRA)

2025 State of Revenue Report

The 7th annual State of Revenue Report reveals the power of data and analytics in optimizing life sciences and high-tech revenue. VIEW whitepaper

Overcoming three key pharma compliance challenges in 2025

Ensuring regulatory compliance has become increasingly complex as the life sciences industry evolves. Pharmaceutical manufacturers across the globe face unprecedented challenges and heightened scrutiny, causing... VIEW whitepaperContact Sales

Thank you for your interest in Model N. Please submit the form and our sales team will contact you within 24 hours.

Our Customers Include:

Thank you for reaching out.

We look forward to responding within one business day.