$68,000,000

The average amount of annual saving that Model N generates for its customers per $1 billion of revenue. See how much you can save with our Revenue Optimization Calculator for High Tech.

Creating revolutionary products is complex, but delivering your solutions to market doesn’t have to be. Model N helps you successfully navigate major challenges - from calculating rebates to managing regulatory mandates, and adjusting to the ever-changing demands of the market - all so you can fuel revenue growth while remaining compliant.

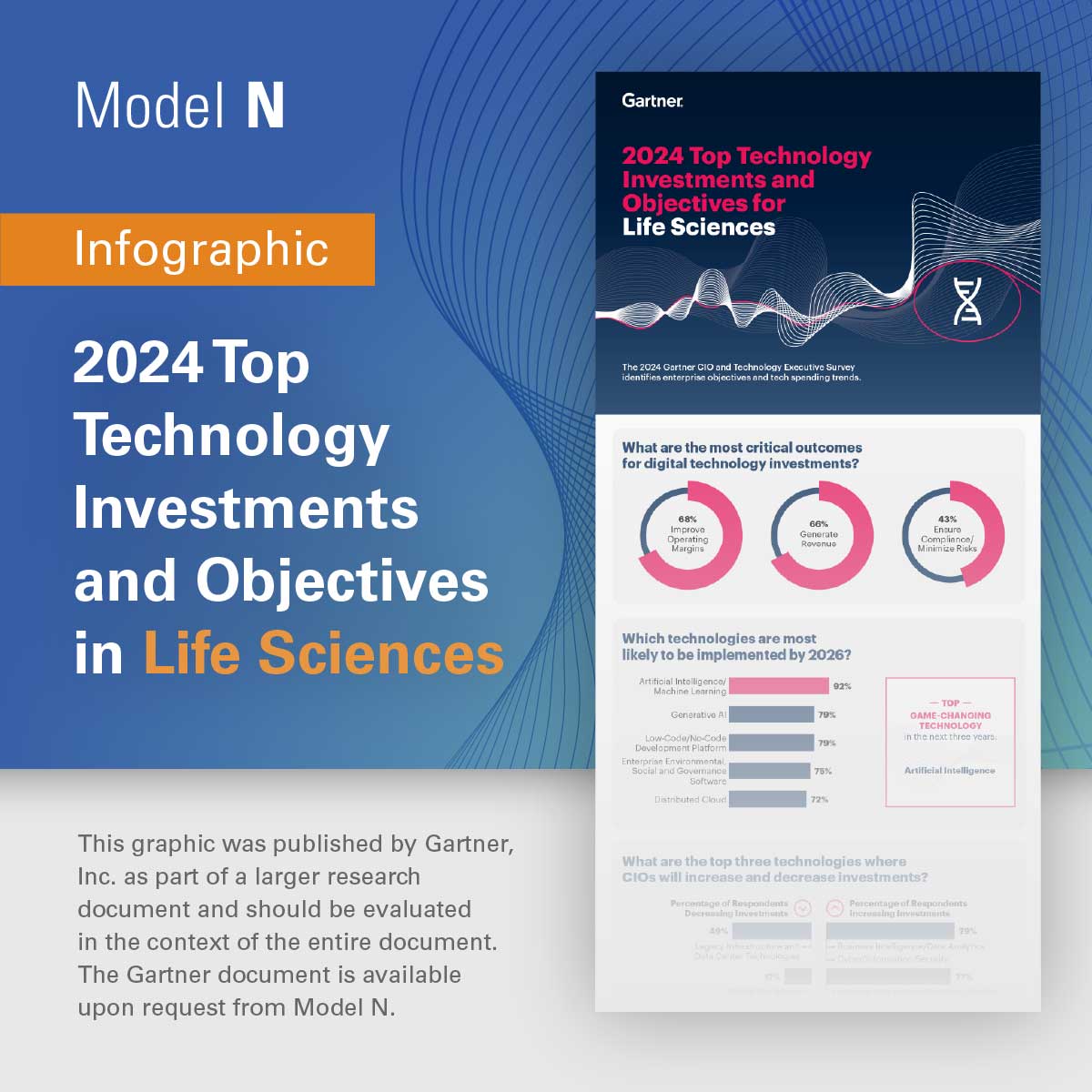

Accelerate digital transformation with cloud-integrated technology, data, analytics, and expert services, so you can respond with agility to market and regulatory changes while mitigating risk and growing your revenue.

Losing revenue stifles innovation. Model N’s purpose-built products and services empower innovators by optimizing revenue to grow your true top line – all while gaining actionable insights and process enhancements along the way.

The average amount of annual saving that Model N generates for its customers per $1 billion of revenue. See how much you can save with our Revenue Optimization Calculator for High Tech.

Accelerate deals by automating price execution, including global price management and automated discounting controls.

Empower your sales force to execute against your strategic objectives, with an intelligent price you can capture more value against all customer product combinations.

Automatically manage channel sales with real-time data and insights into partner performance.

Forrester Report: Leverage Data Management Solutions to Connect and Drive Channel Revenue

From US state and federal regulations to international reference pricing, we have solutions to keep your organization compliant and audit-ready.

Eliminate data validation and rebate calculation challenges by infusing our cutting-edge technology and industry expertise into every step of your commercial processing cycle.

Instantly review and share results and insights with key stakeholders to drive more informed decisions within your organization.

Automate commercialization processes from contract creation to rebate payment.

Deliver access to key data and insights directly to Salesforce.

Improve the profitability of commercial contracts with enhanced compliance.

See how companies like yours leverage Model N to enhance operations, boost growth and optimize resources to drive innovation.

of the top 30 Life Sciences companies use Model N

of the top 25 semiconductor companies use Model N

increase in channel compliance