Making the Case for Tenders

This is the second part of our three-part blog series on Global Tender Management (GTM). For an industry overview and its relationship with technology, see part one.

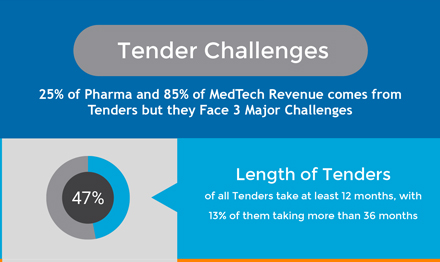

Today, 25% of Pharma and 85% of MedTech revenue is derived from tenders, though this revenue faces three major challenges, therefore resulting in lower profitability. First, many tenders are at least 12 months and even as long as 36 months, creating a situation where manufacturers fear being locked out of a market—or even an entire region—and lose a sizable market share for an extended period of time.

Second, tender authorities are creating new legislations and increasing specification standards, further contributing to their increased negotiation power over manufacturers. Finally, for products that undergo the tender process, their final price is often 50% or more below their original price.

Businesses must also navigate four major issues involved in the tendering process. For example, in 2017 thus far, there were 126,228 Pharma and 182,784 MedTech tenders published globally. Manually sifting through public tender sources is obviously not optimal. Further, once the tenders are identified, manufacturers will typically only have around 35 days to identify and bring together all necessary information—a heavy burden given that any inaccuracy can lead to disqualification. This, in turn, pulls the necessary resources away from what nearly two-thirds of tender professionals see as a key to winning a bid, namely, shaping the bid through payer engagement.

Finally, even if in a very unlikely event that all of the aforementioned steps have been successfully completed, there is one more step to achieve tender excellence, which is tracking and analysis. After all, if the tender is lost, then the company must record competitive info for analysis. If the tender is won, then tracking of the tender becomes priority so it can be fulfilled correctly and potentially extended in the future, resulting in an optimized opportunity.

Unfortunately, typical tendering solutions involve manual, Excel-based systems that limit visibility beyond a local market. Additionally, this information is not easily shared, further discouraging a global tender approach. Other solutions might not consider competitor scoring or the global impact of price transparency in simulations, adding to limited visibility and inaccurate estimations.

These challenges are exacerbated when considering that life sciences companies are severely underutilizing technology to support revenue management, and more specifically, tendering. As a recent IMS report stated, “tenders require an integrated and coordinated approach to gather net price opportunities and challenges and to select those to answer, in light of the likely impact on other countries.”

Review Tender Challenges infographic for more information.

In the final part of our series on GTM, learn how Model N becomes the missing piece in the tender puzzle. Any comments or questions? Send them to vsudol@modeln.com.

Sources

EyeforPharma.com, PharmExec.com, pharmamedtechbi.com, Evaluate LTD, HPS survey, Model N analysis, IMS, GlobalTenders.com, bidsinfo.com, Princeton.edu